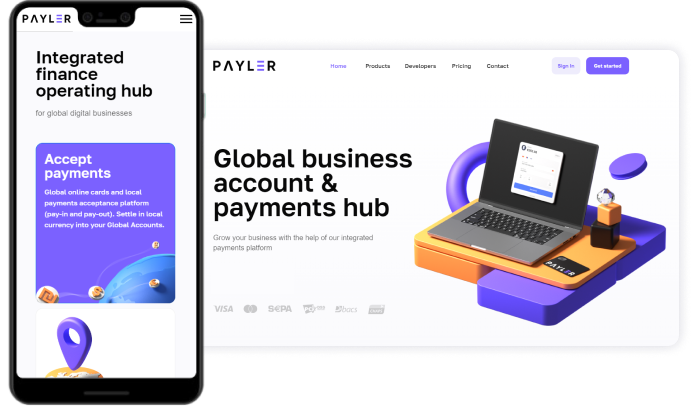

Payler leverages financial building blocks for its global business account and payments hub

Payler faced a classic dilemma: build or buy. Find out how real-life digital banking businesses like Payler can leverage ready-to-deploy financial APIs to achieve their objectives efficiently.

Challenges

- Finding the right partners.

- Launching product as soon as possible.

- Finding a cost-effective white-label solution.

Benefits

- Faster beta roll-out to gather customer feedback.

- Assistance with meeting FCA regulations.

- Access to Integrated Finance's vast knowledge and connections.

Launching a brand new business, especially one as critical as a brand new financial institution, can be a daunting task. Are you are facing a similar challenge? Drop us a line to explore which approach could work best for your fintech.

For Payler, a B2B global business account and payments hub, it was important to find the right partners to help them launch. This case study focuses on how Integrated Finance aided Payler in achieving its objectives efficiently.

The difficulty of new players

At the beginning of its journey, Payler needed to overcome three key issues:

- They were unsure of who the right partners were to help them launch.

- Should they build or buy a white-label solution for their product.

- The MVP needed to launch as soon as possible.

These are fundamental challenges that many businesses such as Payler will face. After all, the slower the rollout, the longer it will take to begin generating revenue.

Starting with Integrated Finance

After evaluating multiple options, Payler realised that Integrated Finance met all of their needs in terms of identifying the right partners, having integrations with key entities, offering an end-to-end product solution, and having a suitable MVP and pricing. All of the contracts were signed at the end of April and Payler was able to launch a beta of its products in July/August. It has continued to iterate on and improve its offering thanks to customer feedback.

Making connections

"The question was: Who do we talk to in both the financial and tech sectors? Our goal was to find a partner who understood both." Arthur Enikeev, CPO at Payler.

Payler was able to take advantage of Integrated Finance's expertise in the financial industry to train some members of their team who were new to the field. This knowledge and experience allowed Payler to onboard new customers effectively.

In addition to providing internal training, Payler also leveraged Integrated Finance's connections to key partners in the industry to help build trust between companies. This assistance with introductions and networking helped facilitate mutually beneficial partnerships for Payler and the companies they were introduced to.

Building a system

Payler faced a classic dilemma: build or buy. In this case, the company was struggling with tight deadlines and knew that if they built their own solution, they would not be able to meet their launch deadline. As a result, Payler was on the lookout for a company that could provide a quick solution at a competitive price that will allow them to save on development times and costs.

Integrated Finance was able to meet Payler's needs with our core banking services as part of our extensive Fintech infrastructure. Payler used Integrated Finance's white-label solution as their MVP to get to market faster.

This allowed Payler to launch on time and have a solid foundation to continue to scale their banking product effectively.

Integrated Finance essentially offered Payler a ready-to-deploy solution that allowed the company to continue to enhance its core product offering without the need to build financial technology’s mandatory and complex software components.

25%

reduction on operating costs

3

months from signed contract to live BETA

45%

reduction in workload for in-house teams