Platforms

Build embedded banking for your earners, powering end user experience

Build on our infrastructure and offer your customers the abilty to hold funds, pay invoices and manage cash flow. Open up new sources of revenue whilst powering better user experience. Bolt on bespoke products your users actually want. Harness our workflow libraries and fund orchestration to increase the productivity of your operation and compliance teams.

Embedded Banking for Platforms

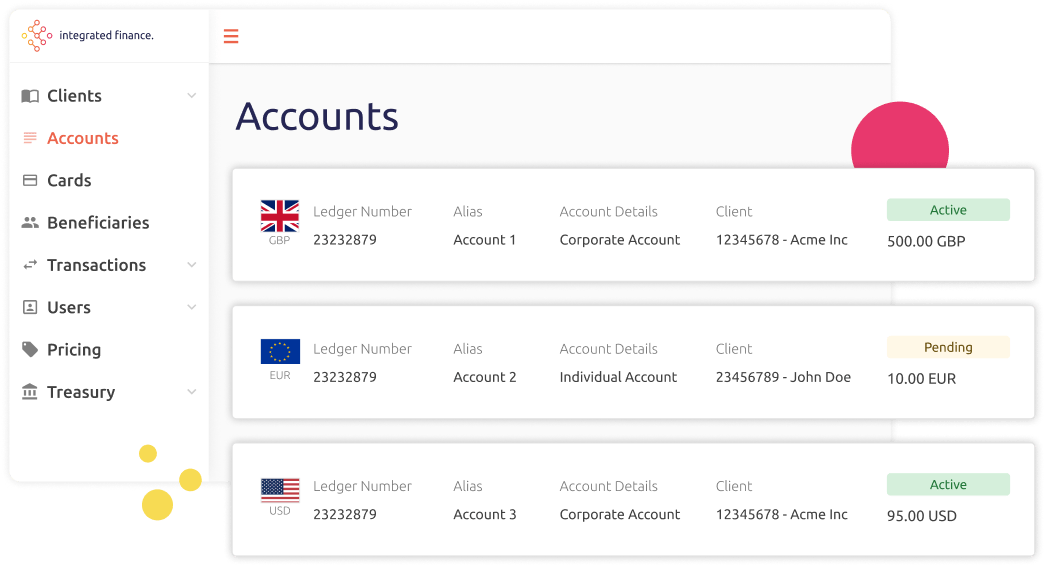

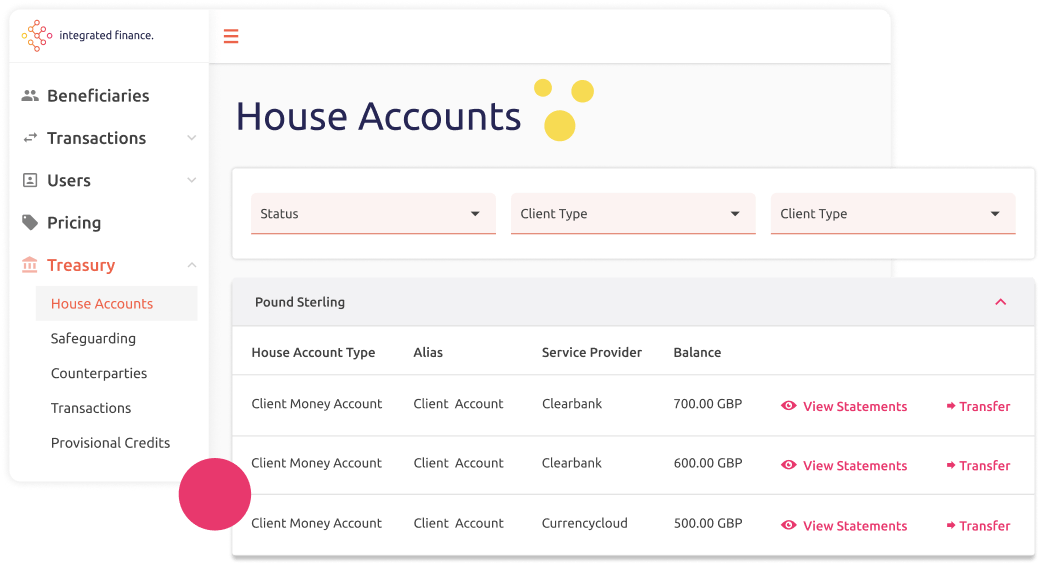

Programmatic Ledger

Record real-time money movements on a programmable financial ledger built for scalable asset tracking. Create different account structures and models to manage both end user and your money across multiple institutions

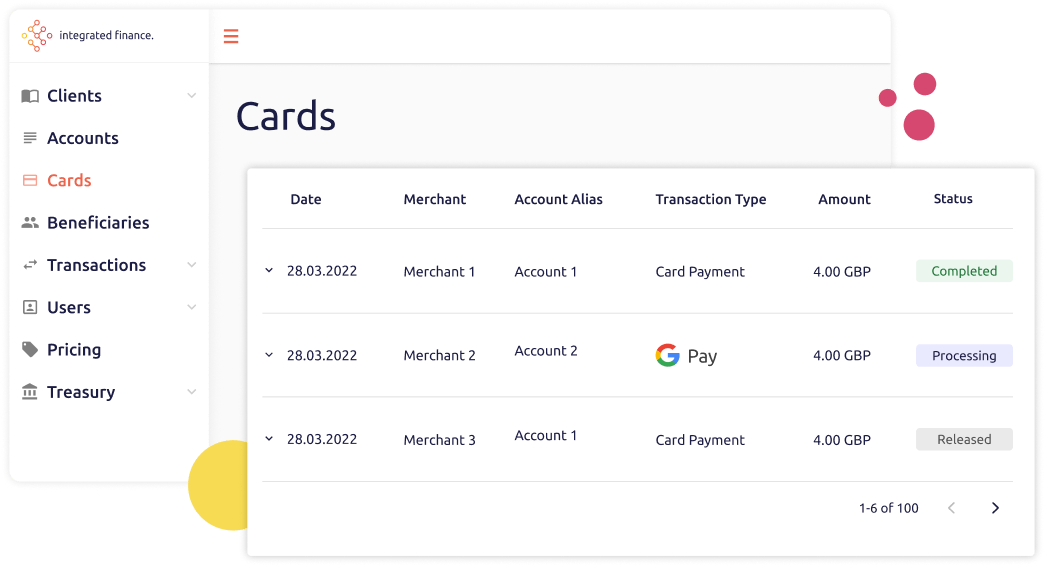

Account & Card Issuing

Offer different account & card types to customers based on use cases and deal economics. Debit, Pre-Paid, Gift Cards. Real & Virtual. Tokenised. Current, Savings, Virtual & Real Accounts. Multi-currency.

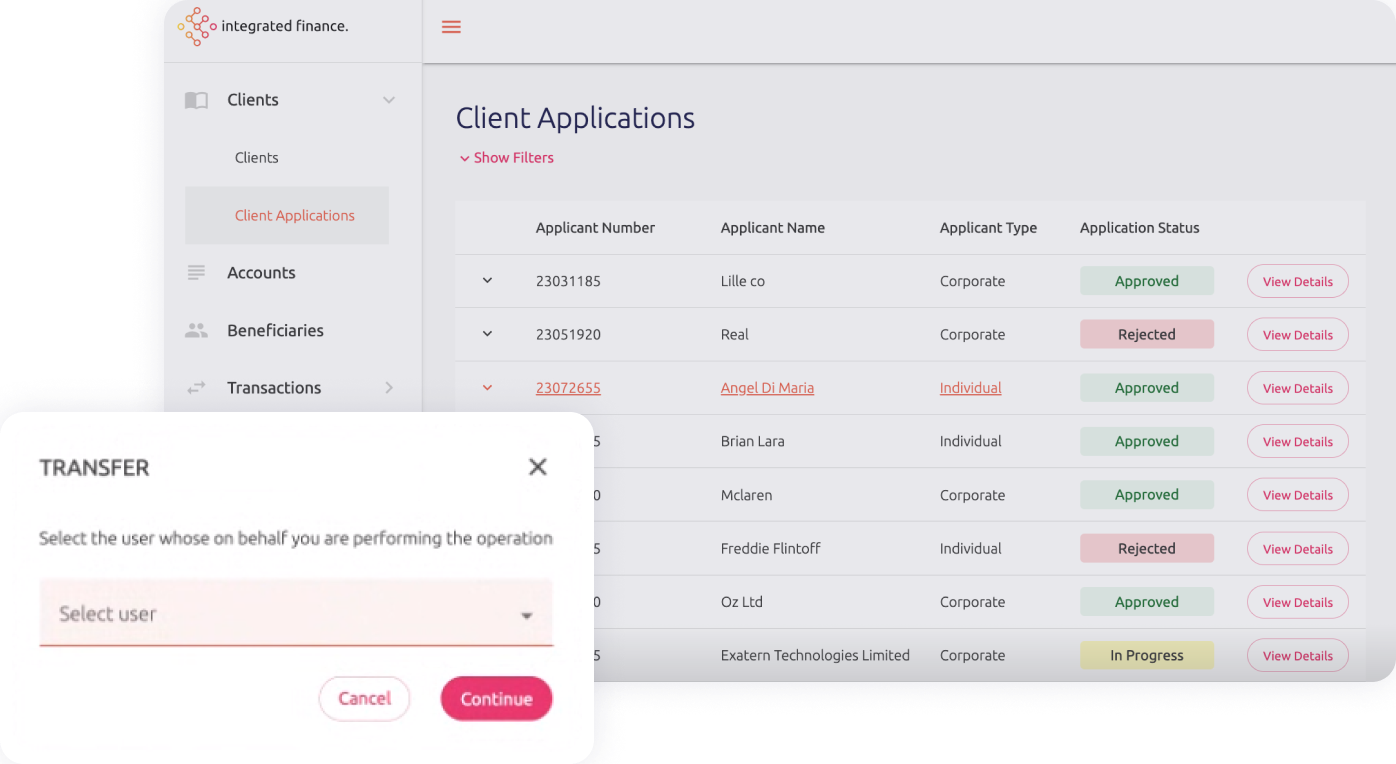

Customer onboarding & Ongoing Compliance

Pre-built integrations and workflows powering frictionless end user onboarding & automatic transaction screening and monitoring. Built-in fraud and risk, confirmation of payee and open banking gateway to connect your accounts to the wider compliance ecosystem

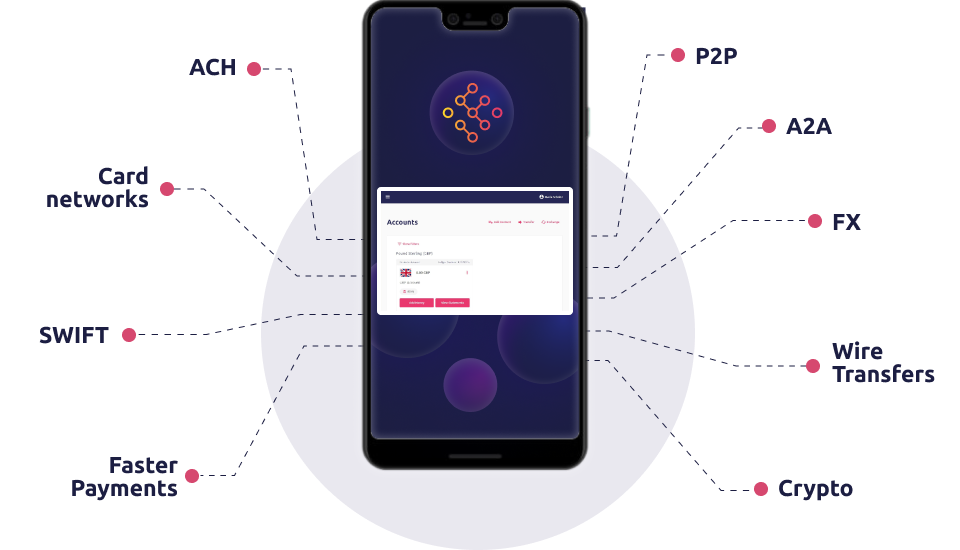

Multi-Currency & Global Money Movement

Create accounts & hold balances in multiple currencies for your customers. Validate, store and manage customer bank details, send & receive funds via local & international payment rails. Create bespoke transactional pricing. P2P Payments

Pre-Built Workflows & Financial Orchestration

Use our pre-built workflows to determine how clients, products, payments and balances are managed or configure yourself. Automate fee sweeping and internal fund movements to power operational teams.

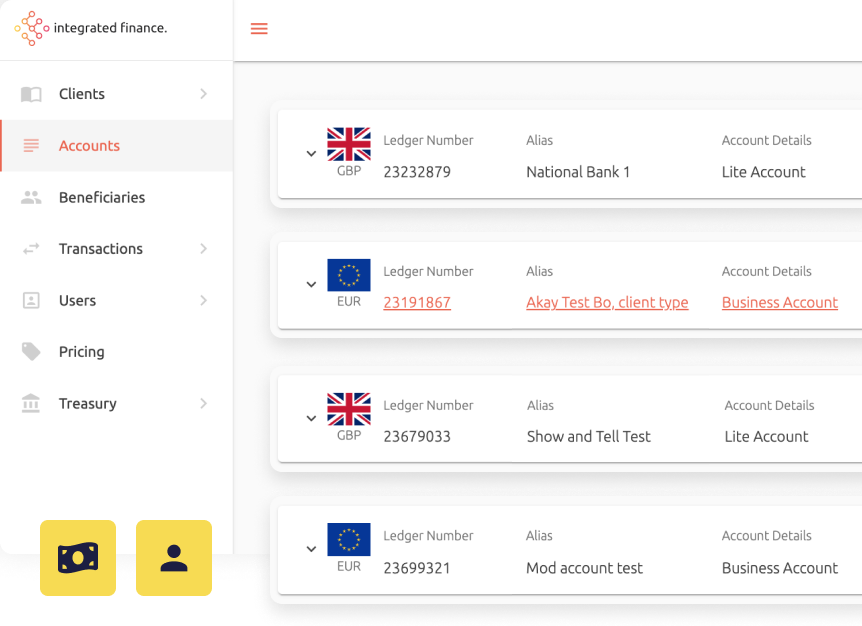

Control & Customisation

Map your own workflows to our platform. Create custom transactions and connectors to any provider using our API. Access our dashboard to Monitor activity, manage users, and respond to issues in real time

Ways to use our infrastructure

Not sure which offering is right for your business requirements? Answer a few short questions and find out.